COVID-19 Vaccine Policy for Medicare Beneficiaries in 2025

Medicare continues to fully cover updated COVID-19 vaccines at no cost to beneficiaries, provided they’re administered by Medicare-approved providers. This includes the latest 2024–2025 vaccines targeting Omicron variants like KP.2 and JN.1 from Pfizer-BioNTech, Moderna, and Novavax. In-home vaccination support also remains in place, offering additional payments to providers to reach homebound individuals—a key benefit for seniors with limited mobility or in long-term care.

Although CMS ended its vaccine mandate for healthcare staff in Medicare- and Medicaid-certified facilities in mid-2023, facilities are still required to educate and offer COVID-19 vaccines. A new reporting requirement, item O0350 in the Minimum Data Set (MDS), helps track whether long-term care residents are “up-to-date” on COVID-19 vaccines as per CDC guidelines, reinforcing ongoing efforts to monitor vaccine uptake.

Vaccine policy has shifted under Health Secretary Robert F. Kennedy Jr., who has prompted the withdrawal of CDC booster recommendations for certain groups. While Medicare coverage remains unchanged for now, beneficiaries should stay alert to future policy changes and consult healthcare providers for the most current guidance.

Changes Coming to How Medicare Covers Telehealth

Many people are well aware of the benefits of telehealth, including convenience and flexibility, as well as access to a broader range of specialists. Under Medicare’s original rules, telehealth services were intended mainly for rural residents , with the aim of connecting patients with remote specialists from an approved medical facility, like a local clinic. During the COVID-19 pandemic, Medicare temporarily made it easier for people to get care from home through telehealth, no matter where they lived. This change allowed beneficiaries to have video or phone visits with their doctors right from their living rooms — a huge help for people with mobility challenges or those living in urban or suburban areas.

Starting October 1, 2025, unless new laws are passed, this pandemic-era home access will end for many services under Original Medicare. The guidelines will revert back to the original rule, meaning in most cases, you will need to be at an approved medical site in a rural area to use telehealth. There are a few notable exceptions, including mental health counseling, substance use disorder treatments, dialysis visits, and a few other services, which will still be covered from your home, wherever you live. If you rely on telehealth, it’s smart to ask your provider now what services you can still get from home, and whether they offer extra telehealth benefits beyond basic Medicare. Some Medicare Advantage Plans may offer more telehealth benefits than the basic coverage in Original Medicare. Stay informed and consult with your licensed insurance agent to help you plan ahead for any changes to your care routine in the coming months.

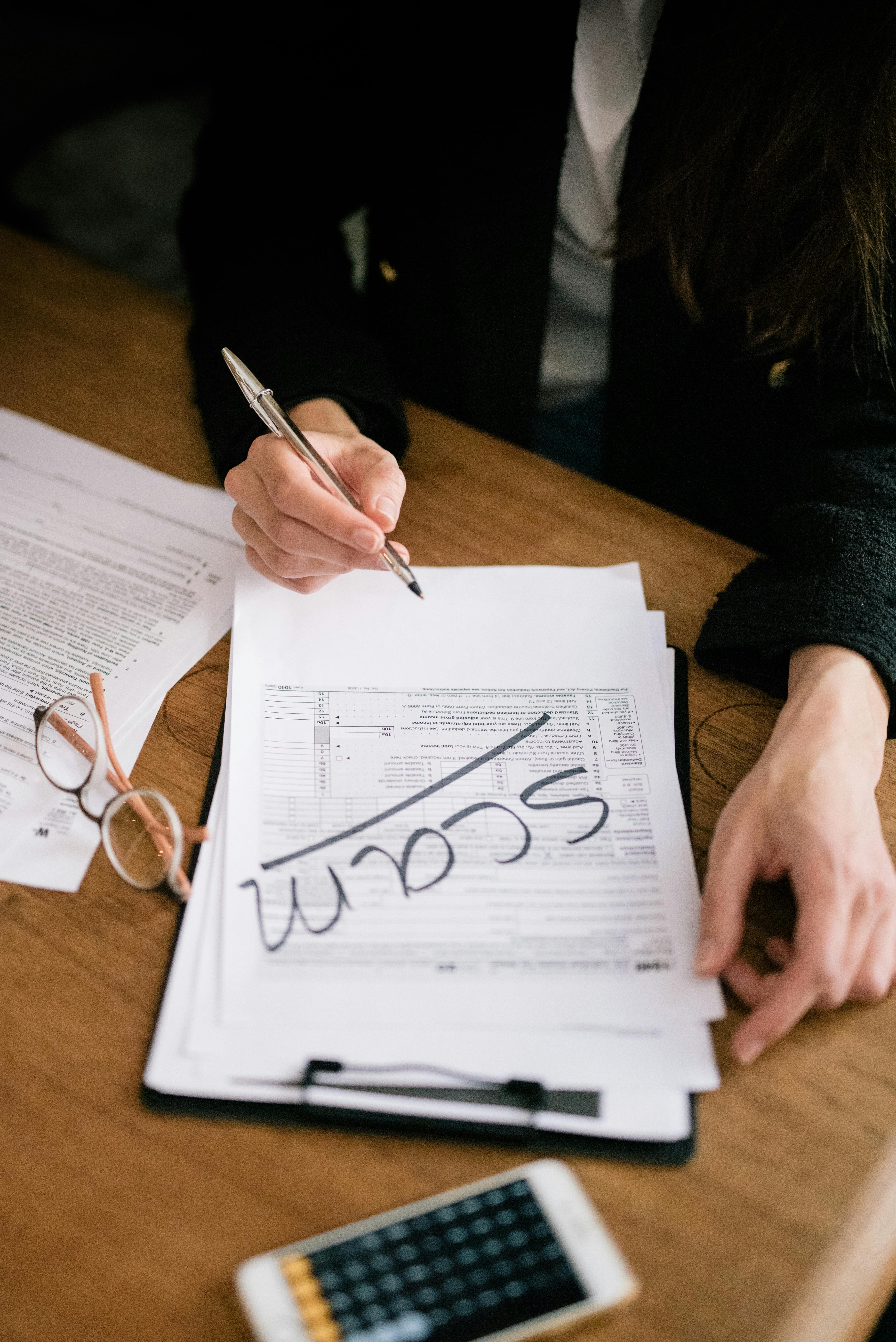

Life Insurance Scams Are Surging in 2025—Here’s How to Stay Safe

Life insurance is more essential than ever, but in 2025 it’s also become a prime target for scammers. With more policies being sold and managed online, criminals are using AI-generated emails, fake websites, and spoofed phone calls to impersonate agents, file fraudulent claims, and steal personal information.

Common schemes include fake policy offers with low premiums and no real coverage, calls from imposters posing as insurers asking for Social Security numbers, and even cases of criminals impersonating beneficiaries to claim death benefits.

Protecting yourself starts with vigilance. Always verify an agent’s license through your state’s insurance department and confirm that your insurer is registered with the NAIC. Be cautious with unsolicited messages, and never click links or share sensitive information without confirming the sender’s legitimacy. If you suspect a scam, report it immediately to your insurer, your state insurance regulator, or the FTC. Life insurance should offer peace of mind—not open the door to fraud.